sales tax in san antonio texas calculator

The minimum combined 2022 sales tax rate for San Antonio Texas is. The December 2020 total local sales tax rate was also 7750.

2022 2023 Self Employment Tax Calculator

Real property tax on median.

. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. The San Antonio sales tax rate is. That includes overtime bonuses commissions awards prizes and retroactive salary increases.

Sales Tax State Local Sales Tax on Food. Texas Sales Tax. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681 on top. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages.

In Texas prescription medicine and food seeds are exempt from taxation. How You Can Affect Your Texas Paycheck. Vermont has a 6 general sales tax but an.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Sales tax in San Antonio Texas is currently 825. And all states differ in their enforcement of sales tax.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Net price is the tag price or list price before any sales taxes are applied. There is no applicable county tax.

The minimum combined 2022 sales tax rate for San Antonio Florida is. Wayfair Inc affect Florida. Calculator for Sales Tax in the San Antonio.

Did South Dakota v. 0250 san antonio atd advanced transportation district. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

Total price is the final amount paid including sales tax. San Antonio Texas and Phoenix Arizona. Maintenance Operations MO and Debt Service.

The results are rounded to two decimals. San Antonio has parts of it located within Bexar County and Comal County. The County sales tax rate is.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The minimum combined 2021 sales tax rate for san antonio texas is. US Sales Tax Rates FL Rates Sales Tax Calculator Sales Tax Table.

Ad See how to streamline your sales tax filings and improve accuracy before annual reporting. There is base sales tax by Texas. Within San Antonio there are around 82 zip codes with the most populous zip code being 78245.

282 Sales Tax Salaries in San Antonio provided anonymously by employees. Use our sales tax calculator or download a free Texas sales tax rate table by zip code. To make matters worse rates in most major cities reach this limit.

2022 Cost of Living Calculator for Taxes. The current total local sales tax rate in san antonio tx is. Before-tax price sale tax rate and final or after-tax price.

If this rate has been updated locally please contact us and we will update the sales tax rate for San. This includes the rates on the state county city and special levels. The County sales tax rate is.

This is the total of state county and city sales tax rates. The current total local sales tax rate in San Antonio FL is 7000. The December 2020 total local sales tax rate was also 7000.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Fast Easy Tax Solutions. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc.

The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio Texas Sales Tax Comparison Calculator for 202122. The Florida sales tax rate is currently. What salary does a Sales Tax earn in San Antonio.

While texas statewide sales tax rate is a relatively. San antonio sales tax calculator. San Antonio TX Sales Tax Rate.

So your big Texas paycheck may take a hit when your property taxes come due. The average cumulative sales tax rate in San Antonio Texas is 822. The Texas sales tax rate is currently.

That makes the San. 2022 cost of living calculator for taxes. Did South Dakota v.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. 2022 Cost of Living Calculator for Taxes. San Antonio collects the maximum legal local sales tax.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in San Antonio TX. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

The current total local sales tax rate in San Antonio TX is 8250. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. Florida are 181 cheaper than San Antonio Texas.

San Antonio Texas and Crestview Florida. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. The County sales tax rate is.

Sales Tax calculator San Antonio. The san antonio texas sales tax is 625 the same as the texas state sales tax. The San Antonio sales tax rate is.

Fill in price either with or without sales tax. What is the sales tax rate in San Antonio Texas. Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

Counties cities and districts impose their own local taxes. The current total local sales tax rate in San Antonio TX is 8250. The minimum combined 2021 sales tax rate for San Antonio Texas is.

This is the total of state county and city sales tax rates. The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta. Cost of Living Indexes.

There is also 1537 out of 2743 zip codes in texas that are being charged city sales tax for a ratio of 56034. Ad Find Out Sales Tax Rates For Free. The December 2020 total local sales tax rate was also 8250.

Sales Tax Calculator Sales Tax Table.

How Much Are Closing Costs For Sellers In Texas

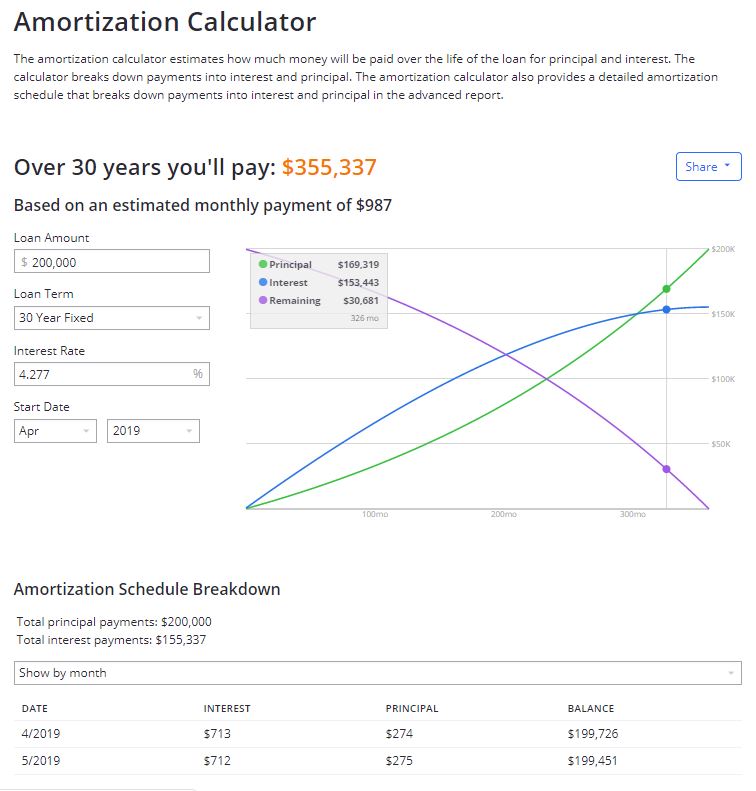

How To Calculate The Qualifying Ratio For A Home Loan

With Guest House Homes For Sale In San Antonio Tx Realtor Com

401k Vs Ira What Is The Advantage Of A 401k Over An Ira Marca

Free Online Paycheck Calculator Calculate Take Home Pay 2022

San Antonio Tx Farms Ranches For Sale Realtor Com

San Antonio Tx Farms Ranches For Sale Realtor Com

Jbsa Tax Centers Open Jan 31 To Assist Military Family Members Retirees 37th Training Wing Article Display

How Soon Can I Sell My House After Purchase Zillow

Registration Fees Penalties And Tax Rates Texas

Is A New Hvac Unit Tax Deductible Christiansonco

How Soon Can I Sell My House After Purchase Zillow

Mortgage Calculator Texas New American Funding

City Of Harker Heights Tx Killeen Harker Heights House Information

Commercial Solar Company Austin Tx Texas Solar Guys

New Home Plan 289 In San Antonio Tx 78260